英特尔 2025 年第二季度

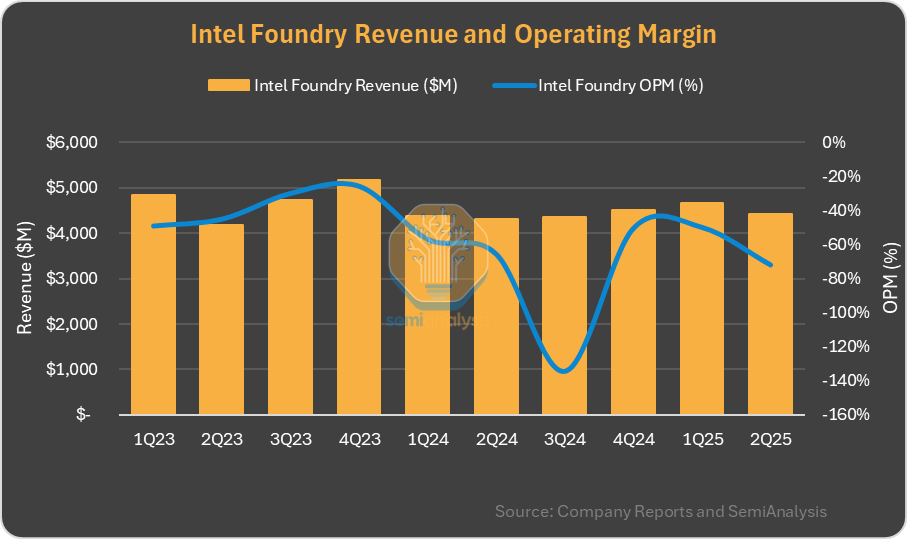

- 除了部分 CCG 业务外,英特尔目前似乎没有其他业务表现良好;在高份额市场(PC/DC)持续受到冲击;AI 参与度有限;代工业务成功取决于 18A 内部产品执行情况,且财务表现远不及台积电水平- 英特尔代工业务收入 44 亿美元,营业利润率-72%;外部代工收入仅为 2200 万美元- 连续第三个季度因关税驱动提前采购(与同行相比异常)来源:Sravan Kundojjala

本文版权归属原作者/机构所有。

当前内容仅代表作者观点,与本平台立场无关。内容仅供投资者参考,亦不构成任何投资建议。如对本平台提供的内容服务有任何疑问或建议,请联系我们。