Apple Option Return Rate

Apple Option Return Rate Alphabet

AlphabetNew Book Sharing Session: "Penetrating the Capital Market"

Attended Professor Han Hongling's new book sharing session at Zhejiang University - "Penetrating the Capital Market".

Gained a lot, sharing some insights.

Fraud - an eternal topic in the capital market.

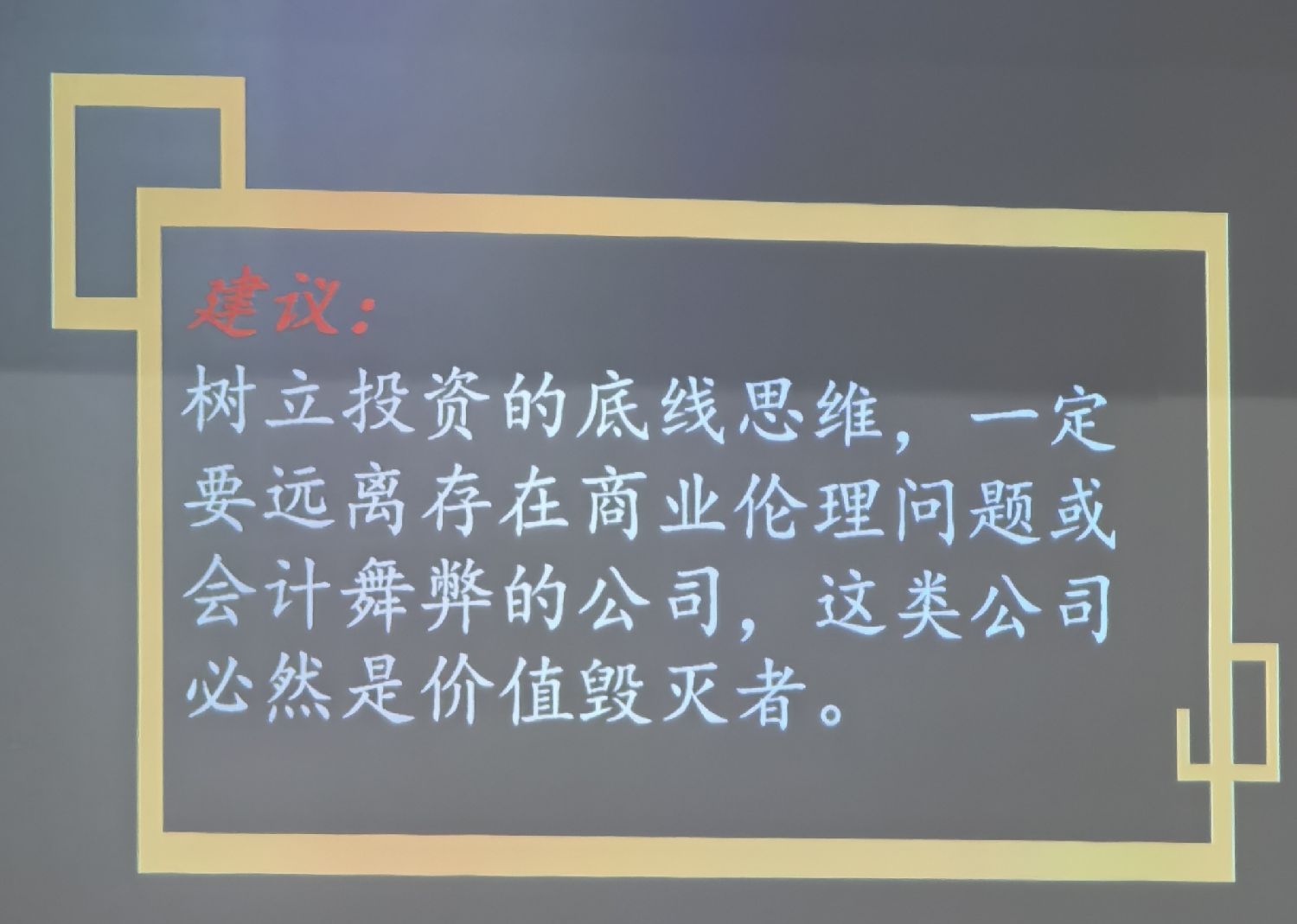

As investors, we must adhere to bottom-line thinking and stay away from companies with business ethics issues or accounting fraud.

Avoiding fraud is one of the main reasons I stick to investing in leading stocks.

Last year, it took me half a year to finish reading Tang Chao's "Step-by-Step Guide to Reading Financial Statements". Although Tang tried to explain in plain language, financial books like this are really sleep-inducing, making it hard to focus and read dozens of pages in one go. While the book lists many signals of fraud, identifying them in practice is still complex and time-consuming.

So, is there a way to avoid worrying about fraud? The simplest method is to invest in leading stocks.

This doesn’t mean leading stocks are 100% fraud-free, but the probability is much lower. For example, all restaurants might have hygiene issues, but chains like Haidilao or Xibei are less likely to have major problems because any reported issue could affect thousands of outlets. Small private restaurants, however, are more prone to hygiene violations.

First, motivation: Leading companies make enough money annually; it’s not worth the risk to commit fraud for marginal gains, especially when exposure could crash their stock price.

Second, the cost of crime: Hiding accounting fraud in leading stocks is extremely difficult due to the scale of funds and operational complexity involved.

Finally, auditing firms: Leading companies usually hire top-tier auditors, who value their reputation and are unlikely to turn a blind eye to issues.

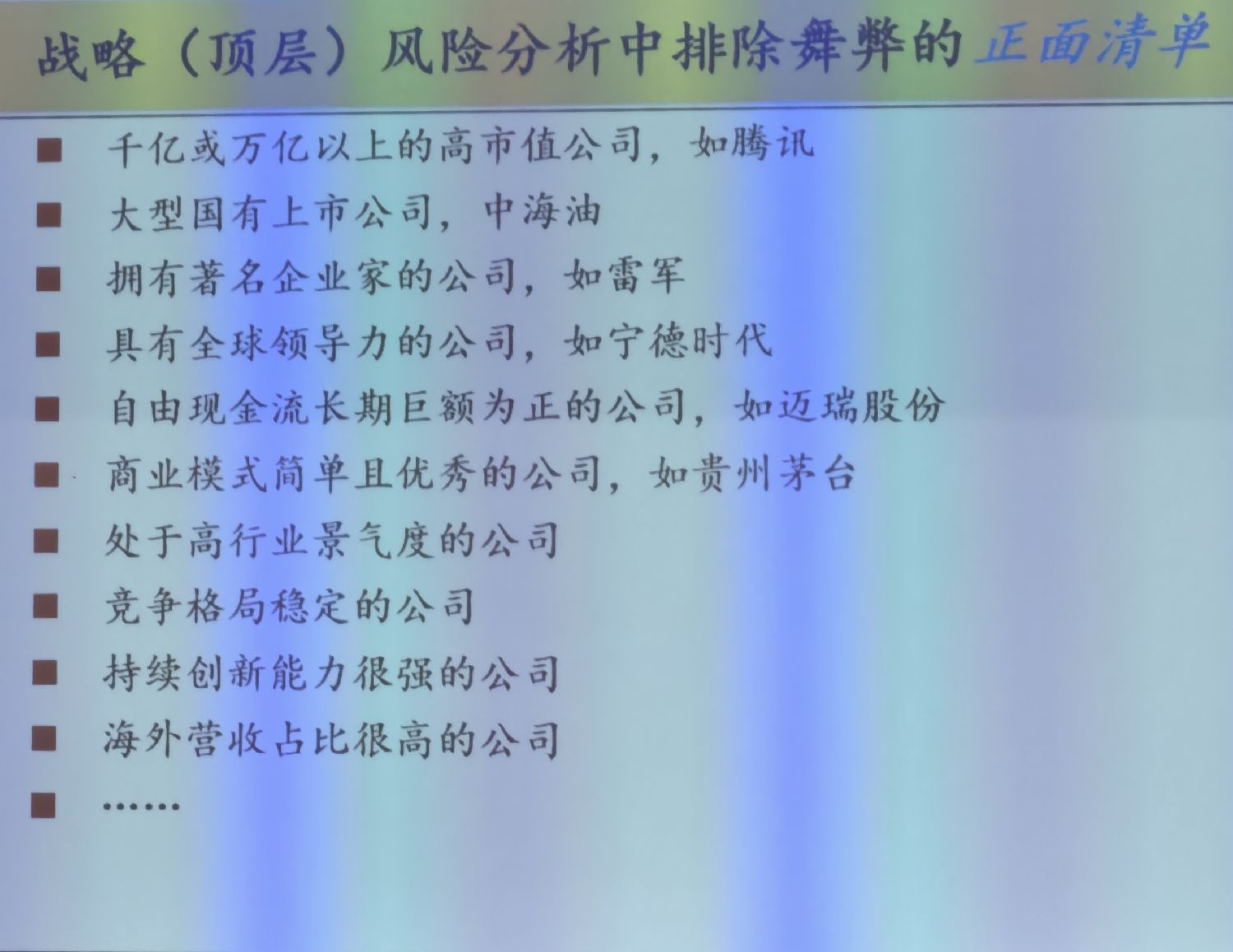

Professor Han listed some positive criteria in strategic risk analysis to exclude fraud, which mostly align with the traits of leading stocks.

Coincidentally, I currently hold 5 of the 6 companies mentioned above. The only one I don’t hold is Mindray Medical (300760.SZ), which I sold in May due to policy risks (overseas exposure was too high).

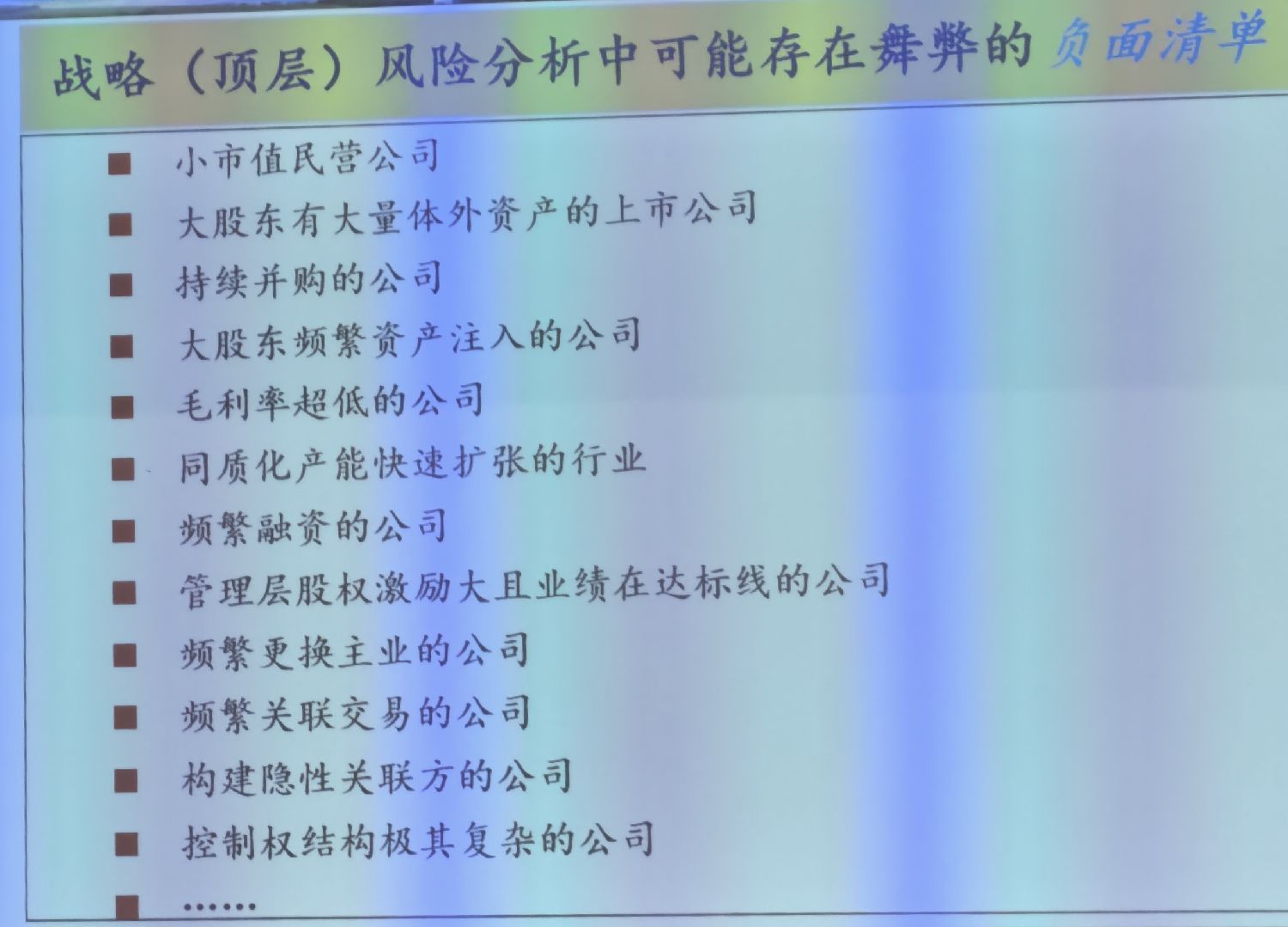

Similarly, Professor Han listed negative criteria for potential fraud in strategic risk analysis, with small-cap private companies ranking first.

The best way to avoid fraud is to steer clear of these "high-risk" companies.

While financial statements aren’t the sole basis for value investing, they are the first step in screening out problematic firms. A company with fraudulent financials is like hiring a candidate with a fake resume—they’re unlikely to add value and may even become a liability.

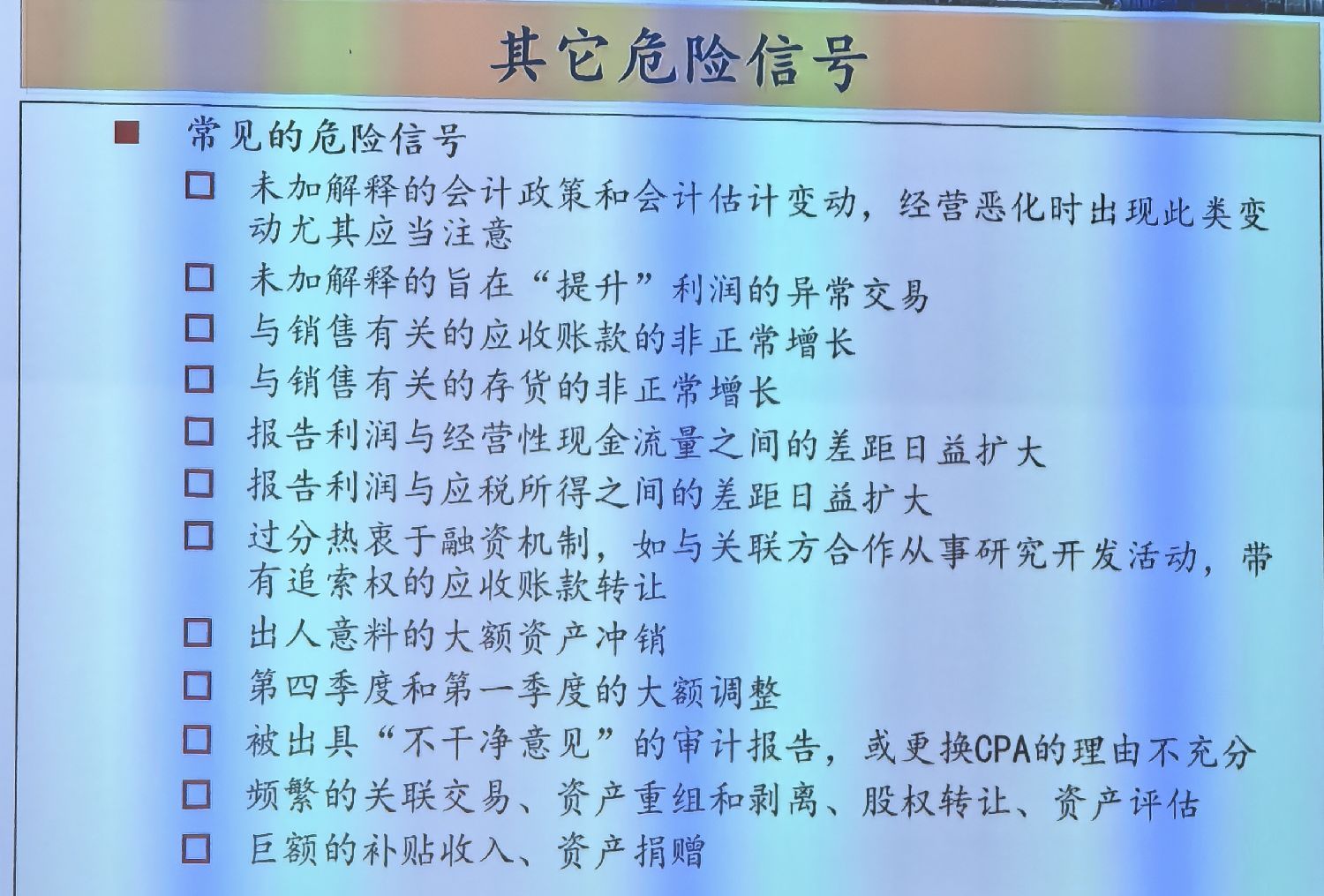

Despite increasingly sophisticated fraud tactics, subtle clues can still reveal underlying issues.

Such issues are numerous, so extra caution is needed when investing in small-cap stocks.

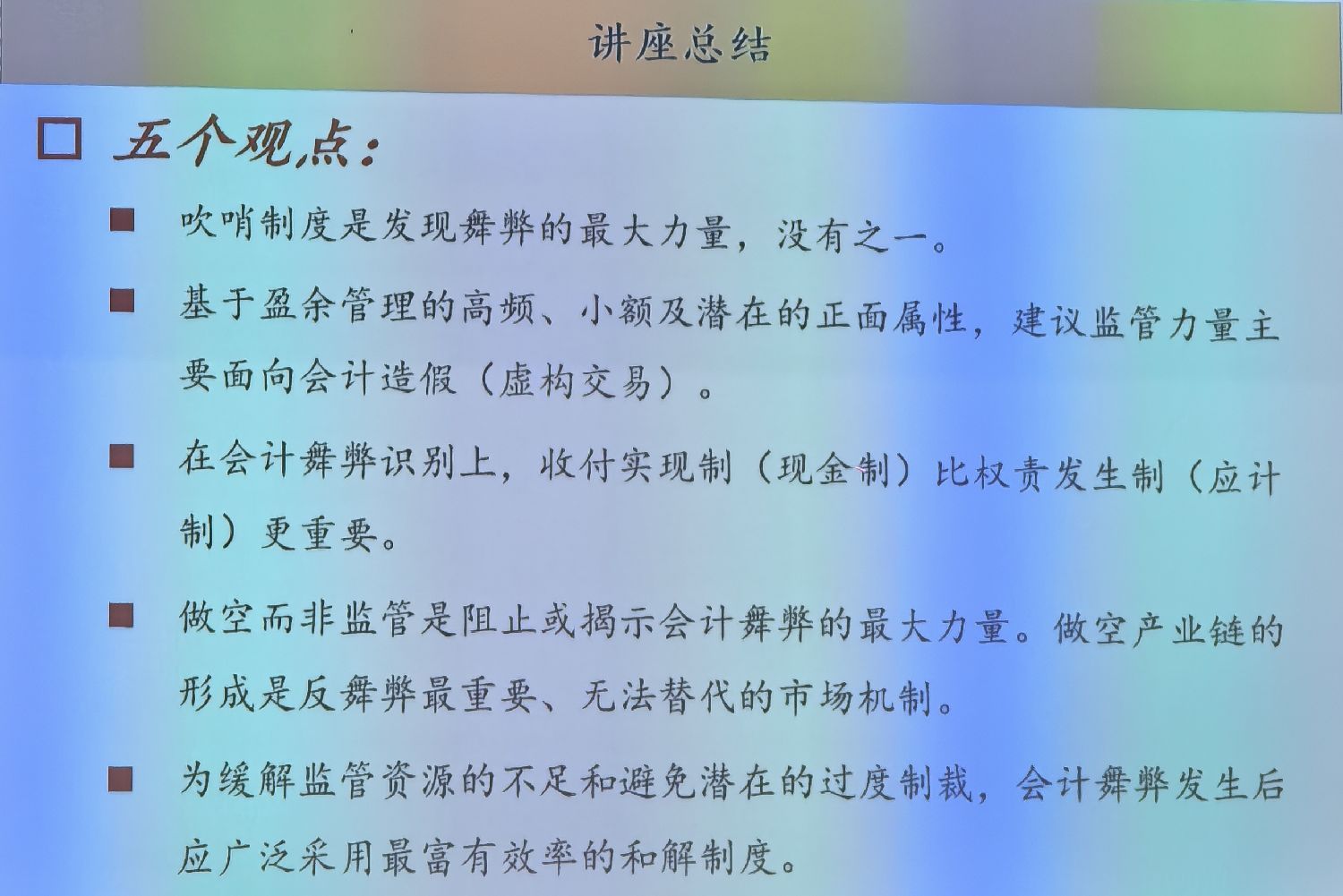

Professor Han also summarized three systems to combat fraud: whistleblowing (to detect fraud), short-selling (to deter fraud), and settlement (to address fraud).

I particularly agree with short-selling. The lack of a robust short-selling mechanism in the A-share market emboldens many listed companies to take reckless risks. Short-selling is an irreplaceable market mechanism against fraud. While it may hurt the market short-term, it’s crucial for long-term health.

You can fool all the people some of the time, and some of the people all the time, but you cannot fool all the people all the time. ---Lincoln

$TENCENT(00700.HK)

$CNOOC(600938.SH)

$CNOOC(00883.HK)

$XIAOMI-W(01810.HK)

$CATL(300750.SZ)

$CATL(03750.HK)

$Mindray(300760.SZ)

$Moutai(600519.SH)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.