Rate Of Return

Rate Of Return Total Assets

Total AssetsSimply understand "AI perpetual motion machine"

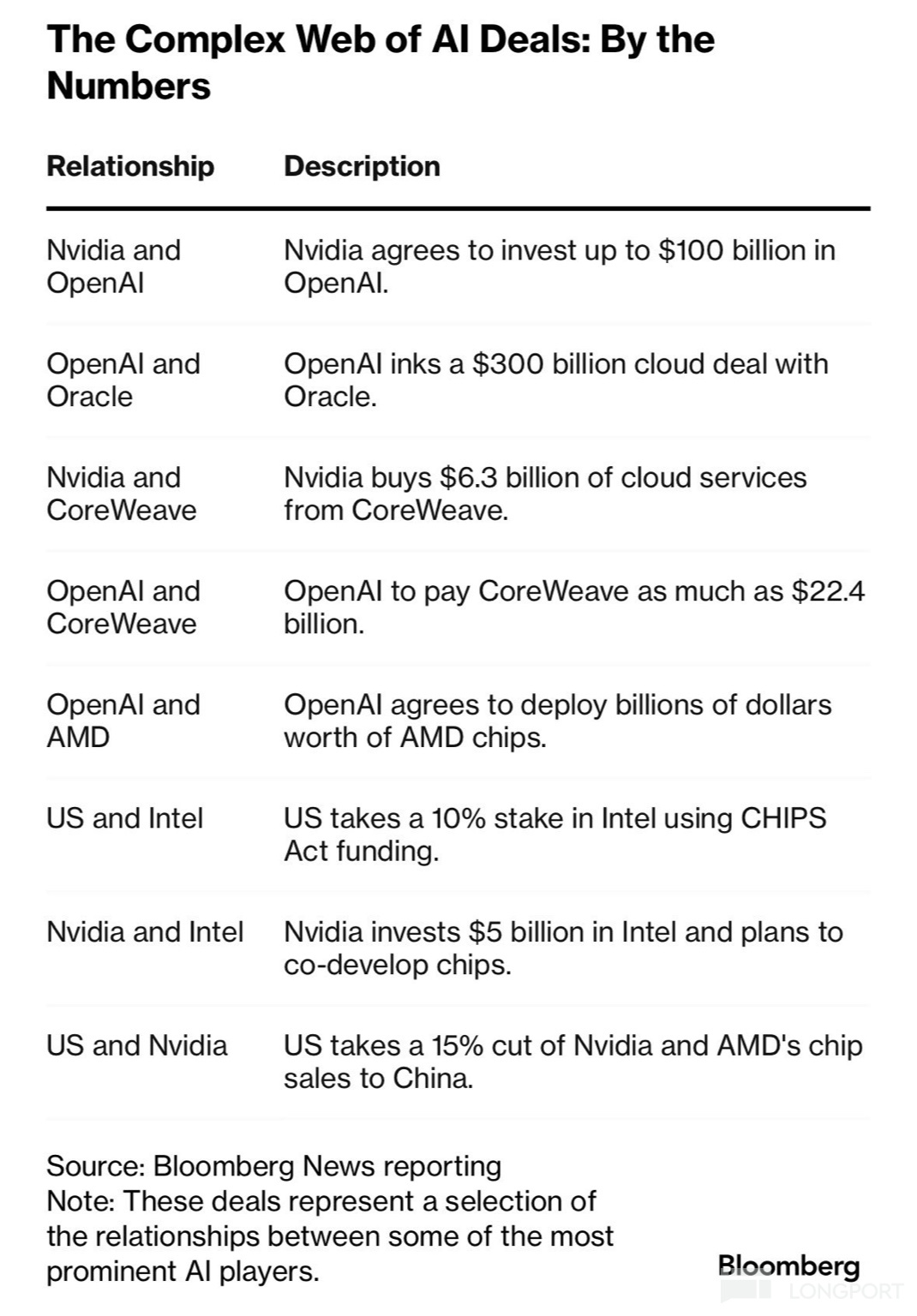

The AI perpetual motion machine describes a flywheel where capital, computing power, models, services, and valuations continuously reinforce each other. The concept of the "AI Money Machine / Perpetual Motion Machine" is an ecosystem where capital and computing power cyclically self-reinforce.

Core Logic: The "Closed-Loop Cycle" of AI Capital and Computing Power

Model providers like OpenAI release new models → Require massive computing power and cloud resources.

Chip companies like Nvidia and AMD supply GPUs → Revenue surges → Reinvest in AI startups or infrastructure.

Cloud giants like Microsoft and Oracle provide computing power and cloud services → Lock in long-term revenue through clients like OpenAI and CoreWeave.

Venture capital and sovereign funds see valuation inflation → Reinvest in startups like OpenAI, Mistral, and xAI → Drive up the overall valuation of the AI industry.

High valuations, in turn, fuel more hardware purchases and cloud spending—keeping the flywheel spinning. This forms an AI Capital Flywheel, where capital and computing power cycle and amplify among OpenAI, Nvidia, cloud providers, and investors.

Why This Model Is Called a "Perpetual Motion Machine"

The core metaphor is the absence of "external energy." Instead, every link in the AI ecosystem—chips, cloud, models, capital—makes capital and growth seem inexhaustible.

Similar mechanism: Nvidia ships → OpenAI buys → Boosts AI application demand → Nvidia refinances or raises prices → Capital reinvests.

Each cycle brings higher valuations, greater computing power expenditures, and larger market expectations. This is what Bloomberg calls the AI Money Machine—a self-driving, self-appreciating system in the short term.

Potential Risks: "Perpetual" Only Under Two Assumptions

First, computing power demand continues to grow exponentially (e.g., GPT training costs double with each generation).

Second, capital markets continue to believe in AI valuation logic.

Risks emerge if:

Model performance growth slows;

New hardware upgrade cycles are delayed;

Or investor confidence wavers (valuation bubble bursts).

In the short term, it has indeed brought massive wealth and industrial revolution.

But in the long run, whether it can remain "perpetual" depends on whether AI can truly create sustained productivity gains—not just capital premiums. The day AI starts "saving energy" for the world instead of "burning money" is the day the perpetual motion machine truly starts.

Source: Bloomberg, Translated by AB KUAI DONG

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.