Intuit 4000-word in-depth research report

$Intuit(INTU.US)$Yonyou(600588.SH) $KINGDEE INT'L(00268.HK) Researched Intuit's report, core logic is high switching cost moat + ecosystem synergy unlocking growth ceiling.

🎯Core logic: US tax software oligopoly serving tens of millions of SMBs, sole proprietors and consumers; SaaS subscription-based model leverages data migration/learning costs to build switching cost barriers; ecosystem synergy maximizes customer value.

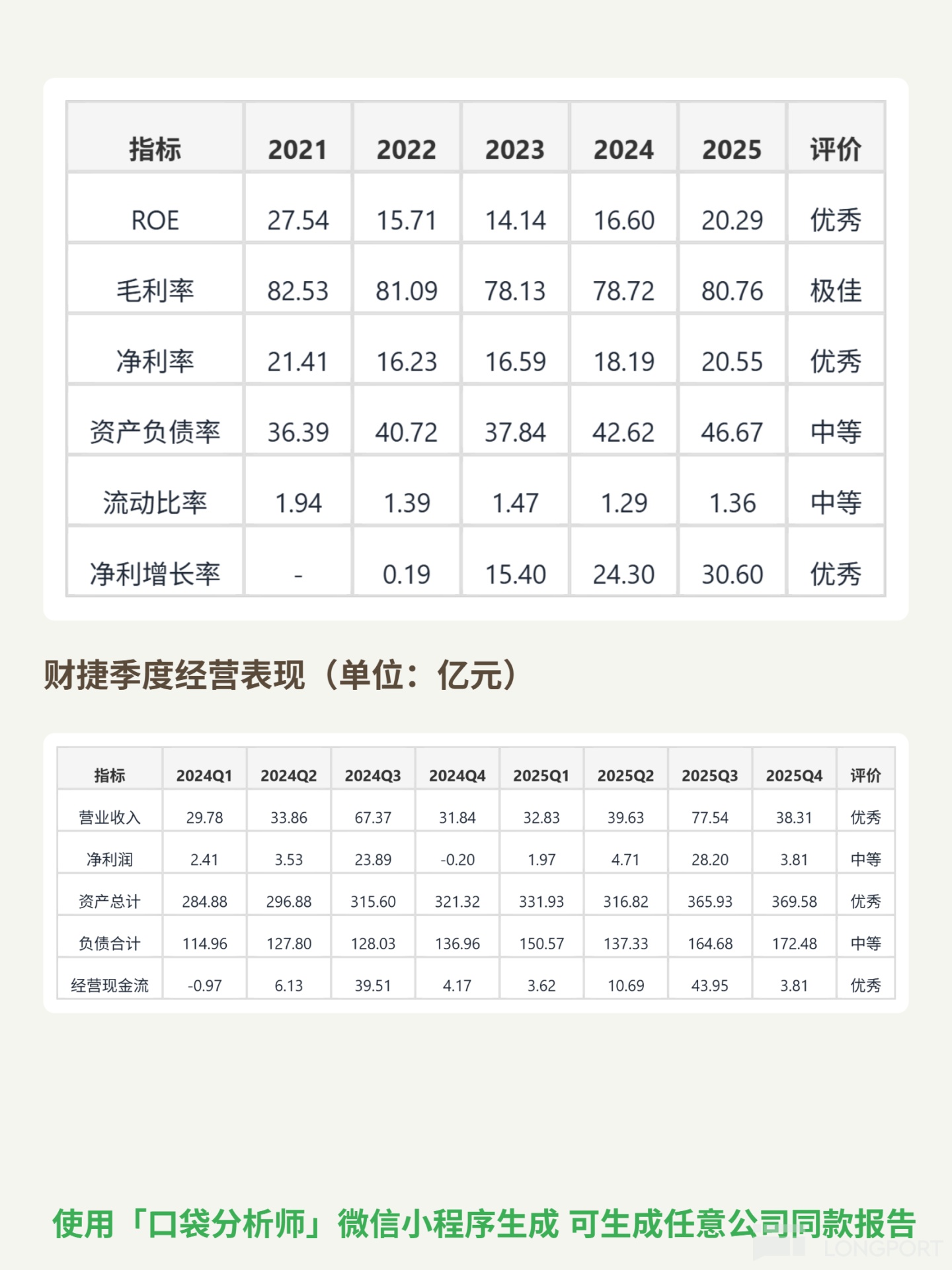

📈Financial highlights: 2021-2025 revenue CAGR 18.2% (¥9.633B→¥18.831B); 2025 ROE 20.29%, gross margin 80.76%, net margin 20.55%; FCF ¥6.083B (5-year positive streak exceeding net profit); subscription model drives highly predictable cash flows with LTV far exceeding CAC.

🔍Ecosystem synergy: Acquired Mailchimp (marketing) and Credit Karma (finance) to expand into marketing/financial services; covers full SMB operation chain (marketing→finance→HR); data flywheel effect (cross-business data empowerment) enhances competitiveness.

💰Business model strengths: Clear revenue structure (70% SMB, 25% consumer); stable recurring cash flows from subscriptions; strong cross-selling capability; continuous customer value expansion.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.