Atour 4000-word in-depth research report

$Atour(ATAT.US)$H World(HTHT.US) $JINJIANG HOTELS(600754.SH) Recently studied Atour (ATAT.US), its asset-light + scene retail model in the mid-to-high-end hotel sector, coupled with impressive financial data, is the core investment value.

🎯Core logic: Atour positions itself in the mid-to-high-end hotel sector, avoiding the red ocean of economy hotels and the trap of luxury heavy assets. The core of its business model is asset-light franchising (90%+ franchised stores) collecting management fees and system usage fees; while transforming hotel spaces into retail scenes (e.g., mattresses, toiletries), IP co-branded rooms have a premium rate of 25%, user repurchase rate exceeds 45% (industry average <30%), and single-store staff-to-room ratio is as low as 0.18 (industry average 0.25+).

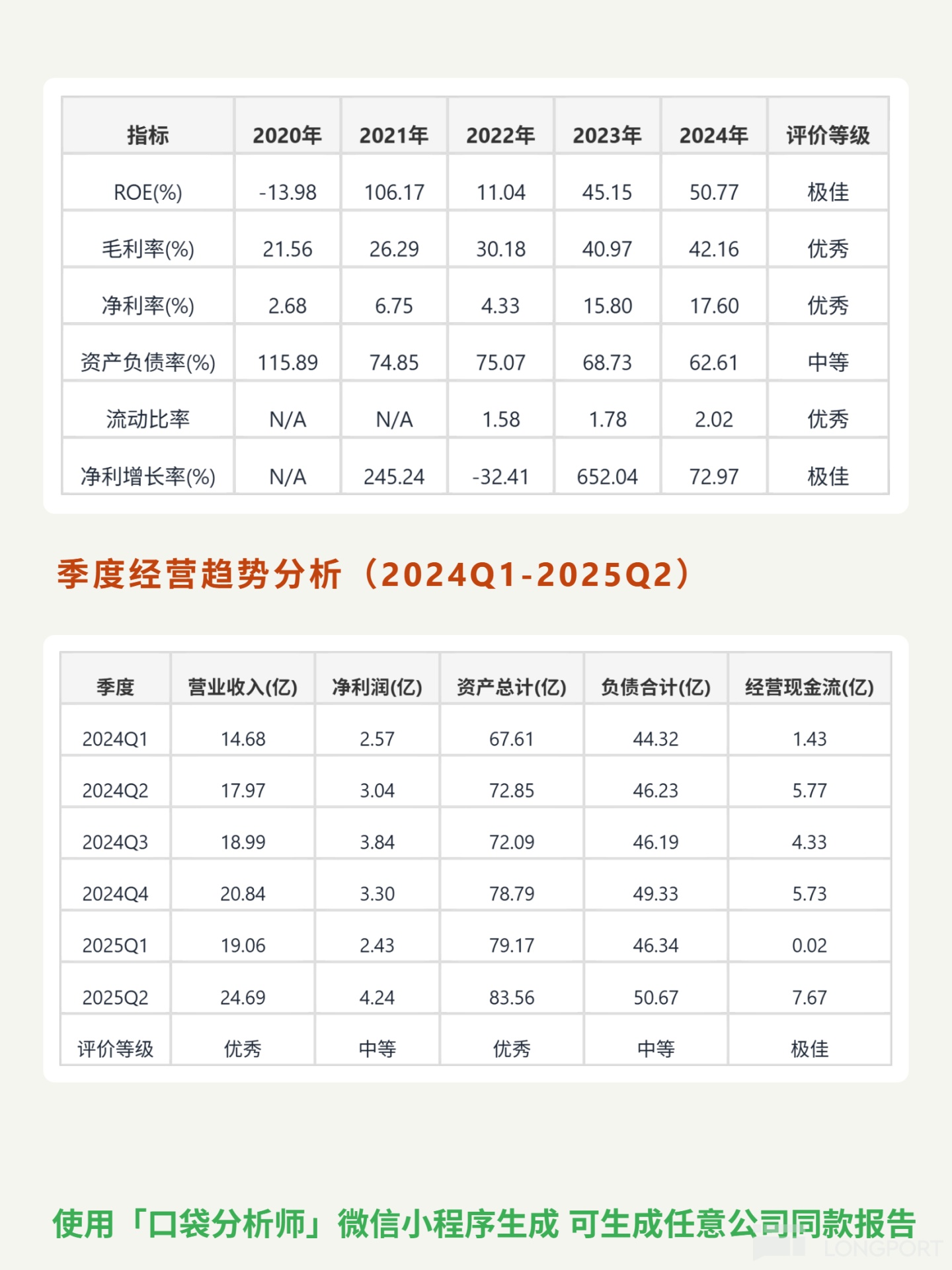

📈Financial highlights: 2024 ROE reached 50.77% (excellent shareholder capital efficiency), gross margin 42.16%, net margin 17.60%; net profit growth 72.97%, revenue CAGR 2020-2024 over 35%; free cash flow RMB 1.67 billion (positive for five consecutive years), net profit cash ratio stable >1.0; current ratio 2.02 (no short-term debt worries), debt-to-asset ratio dropped to 62.61%; 2025Q2 operating cash flow RMB 767 million, capex ratio <5%, fitting cash cow characteristics.

🔍Key details: Paid members exceed 35 million, contributing ~70% room nights; 2024 retail business gross margin 71.5%, becoming core profit growth driver; 2025Q2 gross margin 45.56%, net margin 17.19% hit record highs, strong growth momentum.

💰Cash flow quality: Operating cash flow positive for five consecutive years, 2024 FCF RMB 1.67 billion, all profits converted to cash with no inflation risk; low capex ratio, outstanding financial resilience.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.